Case Studies: Cuscal

Cuscal is an Australian based company whose business is payments. Cuscal is Australia’s leading provider of innovative, reliable and secure payment solutions for businesses of all shapes and sizes.

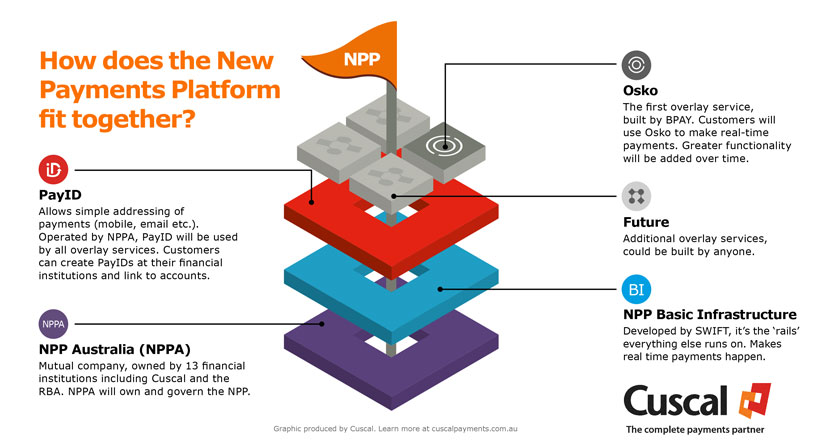

Cuscal is an Authorised Deposit-taking Institution (ADI), with extensive capabilities including card and acquiring products, mobile payments, fraud prevention, EFT switching and settlements. Cuscal is one of the primary architects of Australia’s NPP and also runs the rediATM Scheme, one of Australia’s largest ATM networks.

With over a hundred clients from a range of industries (including financial services, airlines, fintech and retail) they make payments easy for customers through technology, scale and licensing.

Being connected to major industry boards and associations allows them to make their clients’ views and interests heard at the highest levels, giving a fair go and creating a more level playing field.

The NPP challenge

In 2012 the Reserve Bank of Australia (‘RBA’), set a challenge to the Australian financial industry – make payments in real time for every Australian by 2018. This was a first mover decision for Australia and the largest change in a decade.

Real time payments came into effect in early 2018. It revolutionised the way that business and consumers interact with payments, allowing payments to be made 24 hours, 7 days a week, in real time.

Cuscal was involved with the RBA’s initial planning on real time payments and later joined twelve other financial institutions (including NAB, CBA, ANZ and Westpac) as part of the New Payments Platform Australia (NPPA).

Cuscal firmly committed to the challenge and took on the requirements from RBA and the NPPA for its clients, involving multiple stringent scenarios creating a very complex operating environment to be delivered in tightly defined timeframes.

Rashu explains how NPP works at Cuscal, “With the NPP at Cuscal we essentially act as the middleman to process real-time payments, track settlements and manage disputes and investigations on behalf of our clients. We also have our own white-label mobile banking solution that our clients and their customers can use to make real-time payments as well as manage all of their mobile banking needs”.

It was only in the last couple of years that New Payments Platform (‘NPP’) really took form. As the 2018 deadline approached, Cuscal found themselves at a critical point in the project.

Payment processing has five or six streams that all work with the Cuscal’s NPP Payments Engine and it’s that critical area where we ended up needing help

Rashu Kharbanda, Head of Architecture & Solution Delivery, CUSCAL

“Fastlane Solutions Agile process trained our entire team to look for the most critical task to solve without losing the big picture”

Rashu Kharbanda, Head of Architecture & Solution Delivery, CUSCAL

Fastlane’s solution

Fastlane Solutions started helping Cuscal in December 2016. It was at a critical point involving Cuscal’s NPP initiative. Cuscal’s team needed to act quickly and change the way they were operating to become agile.

Fastlane Solutions tendered with three other companies and spent time to understand the most critical problem to solve in the NPP initiative, meeting with key stakeholders in the project to further understand the team, existing culture and operating techniques.

Den Burykin, Managing Director of Fastlane Solutions says of the project, “It’s not often that you see a whole country switching to real-time payments … we were facing a very unique challenge with Cuscal which all needed to happen very quickly. Cuscal’s team had come a long way, it was right at a critical point, we had to act … we adopted an open mind, practiced patience and had honest respect for Cuscal’s team for past and present achievements”.

Using Agile practices, visualisation and collaboration techniques, Fastlane Solutions quickly aligned teams and programs, creating an openly transparent environment which empowered the team to solve the most critical problem first, better, faster, which created the greatest impact for the NPP initiative.

Using Agile, the teams started solving problems faster creating positive experiences from continuous learning.

Supported by the senior leadership team Fastlane Solutions then went on to help Cuscal transform its NPP team structure and operations leading to better problem-solving, greater alignment and stronger ownership.

Once a culture of Agile thinking and continuous learning was established, Fastlane Solutions then moved towards scaling and process automation (Continuous Integration/Continuous Delivery) to further accelerate change.

Fastlane Solutions committed strategically to multiple facets of engagement with Cuscal, applying training, program management, Agile coaching, change and risk management, as well as automation expertise – always staying objectively aligned to Cuscal’s goals.

Working across multiple levels from individuals in the teams to senior leadership to programs, portfolio, and later broader organisational aspects, Den says ‘As Agile practitioners, it made us even more aware that there’s no one size that fits all when it comes to Agile mindset, culture and team transformation. It really helped us sharpen the art of Agile advisory in highly challenging situations which at project end saw Cuscal run like a well oiled machine’.

What Cuscal was able to achieve for their clients with the NPP solution within the constraints of New Payment Platform Australia’s time frame was a whole new level in terms of complexity and value-add – Cuscal results were astonishing to say the least.”

Get In Touch